How to Invest With Confidence

- Jasdeep at Democrafy

- Dec 29, 2023

- 4 min read

The goal of investing is simple – to grow the value of your money without taking excessive risk.

Most people would agree with this definition. But few people invest sensibly. Why this dichotomy?

Let’s answer by looking at what investing actually means.

THE INVESTING SPECTRUM

Investing encompasses many things. There is one common thread – buying assets which will generate value and grow your wealth.

On the safest end of the spectrum, that means holding assets in a current account, paying you 2% interest. On the other end, it may be putting 100% of your assets into your own business. In between, there is the stock market, property, art, wine and much more.

Key message – there are different ways to invest.

The type of investment we most commonly discuss is stock market investing. Let’s explore this further through an example.

THE ONE COMPANY EXAMPLE

Imagine a business with £1 million per year in profit and a valuation of £15 million.

That business trades at 15x its earnings.

If you buy that business for £15 million, you will receive £1 million in profit each year. That’s a 6.7% return (£1 million profit divided by £15 million paid is 0.067, or 6.7%).

So if nothing changes, your investment is generating 6.7% return each year.

That in itself is a good return – far better than a current account yielding 2%.

And if your business’ profits grow, your returns will be ever greater. For example, if profits grow by 10% each year, then after a year profits will go from £1 million to £1.1 million. And if your business is still valued at 15x earnings, the new value of your business will be:

15 x £1.1million = £16.5 million. That’s a 10% increase in the value of the business.

So you will receive 6.7% return from the profits, which you might pay to yourself as a dividend, plus 10% return from higher earnings. Your total return will be a whopping 16.7% - far higher than a current account return.

That’s a tad optimistic. A solid, mature company may trade at 15x earnings, and grow those earnings around 3%/year. So that’s a 6.7% return from annual profits, plus 3% growth for a 9-10% total return.

That’s the average return for the stock market over the long run – and that makes sense. The stock market is merely a group of companies.

The problem with the stock market is that most participants forget about the underlying businesses. They speculate instead. This provides volatility and makes most investors nervous. As such, they fall into bad traps.

DIRECTION VS VOLATILITY

The chart below shows two lines. One is a smooth increase in the value of a business (Blue Line). The other is a series of peaks and troughs in the stock market value of a company (Orange Line).

Most individual investors don’t understand this chart.

The Blue Line is what matters. It shows that as time passes, a company’s earnings increase and, as a result, the company becomes more valuable. Using our previous one company example, imagine the earnings go from £1 million to £2 million over time. The value of the company will also rise. That’s all you need to do – take advantage of long-term growth over time.

But the Orange Line is the Devil’s Distraction. It’s what stock market prices actually look like, because of speculation around the economy, impatient investors, interest rate forecasts, geopolitics etc. You get the picture. It’s noise.

The direction matters, not the volatility, especially for long-term investors (which we should all be). If you ignore the Orange Line and focus on the Blue Line, you will be financially successful.

But individual investors become greedy, and try to take advantage of the Orange Line. They try to buy at the bottom (point B) and sell at the top (point C). The reality, however, is that they are overconfident when the market rises and invest more (at point A), before becoming fearful and selling at the bottom of the market (at point B).

Fewer than 5% of professional investors can take advantage of the Orange Line and time the volatility in markets, because it’s not as smooth and predicable as this chart. So the chances of you being able to do so as an individual investor are effectively zero. In other words, don’t bother trying – the odds are against you and you will lose money.

Still tempted to try? Don’t! Focus on the Blue Line and take advantage of being a long-term investor.

BENEFITS OF DIVERSIFICATION FOR THE INDIVIDUAL INVESTOR

Until now, we’ve spoken about single companies. But an individual investor would be sensible to use diversified, typically using low-cost instruments like ETFs (exchange-traded funds) and index funds.

The benefit of these diversified instruments is that they own a large number of companies – so the rise or fall of a few companies won’t have a major impact on your returns.

Instead, you’re exposed to the aggregate results of all companies within an index, like the 500 largest companies in the US via the S&P 500 index.

Sure – there will be times when you make negative returns, perhaps even for two or three consecutive years. But over the long-term, a 6-12% return is a reasonable assumption. The especially good and especially bad companies will offset each other and you will have an average stock market return.

Over time, this will beat a current account, hands-down.

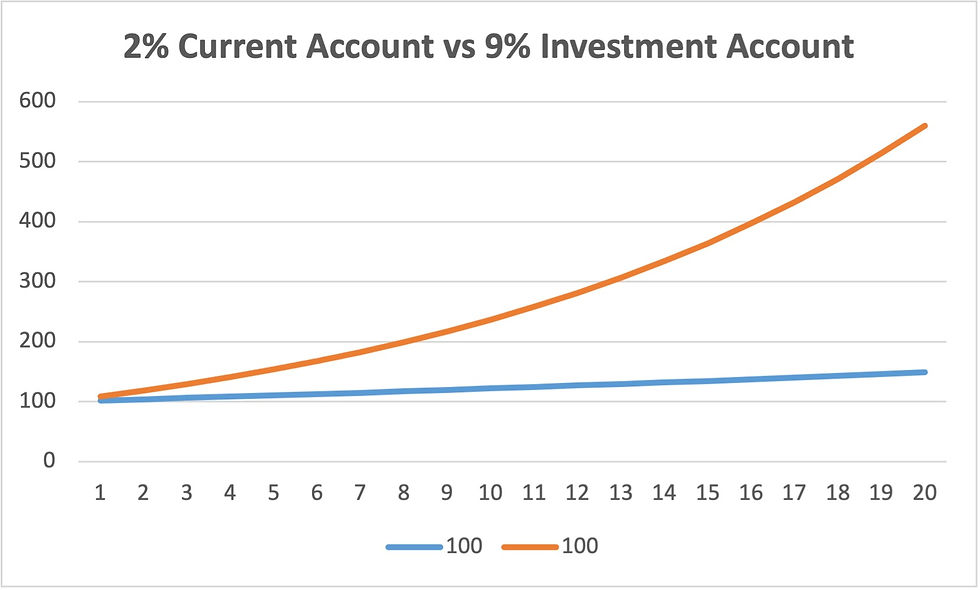

Let’s take a 9% return vs a 2% return over 20 years:

GOOD DECISIONS ADD UP

Have you heard about the millions of financially successful people who kept their investments in a current account? No, me neither.

No-one ever got rich by avoiding investing. But plenty of people got rich by embracing it.

In the financial frameworks we discuss at Democrafy, it’s all about putting together better financial habits which, over time, make a major impact.

Out of these habits, investing is one of the most important.

Action point – go and set up an investment account today. Email me with any questions.

Comments